See Note 5 for other sources of income subject to WHT. Tax Rate of Company.

Malaysia Personal Income Tax Guide 2022 Ya 2021

In most of the countries of the world the corporate tax rates are higher than those of Malaysia.

. On the First 35000 Next 15000. Corporations making payments of the following types of income are required to withhold tax at the rates shown in the table below. The latest value from is percent.

The rate of service tax is 6. Average Lending Rate Bank Negara Malaysia Schedule Section 140B. Countries is 0 percent.

On the First 5000 Next 5000. Malaysian entities of foreign MNC groups will generally not be required to prepare and file. Corporate Tax Rate in Malaysia remained unchanged at 24 percent in 2021 from 24 percent in 2020.

Tax rates of corporate tax as of Year of Assessment 2021 Paid-up capital of RM25 million or less. On the First 2500. Fortress Minerals posts 418 fall in net profit after tax.

The ad valorem rates of import duties range from 2 to 60. Special tax rates apply for companies resident and incorporated in Malaysia with an ordinary paid-up share capital of MYR 25 million and below at the beginning of the basis period for a year of assessment. Data published Yearly by Inland Revenue Board.

Inland Revenue Board of Malaysia 10Y 25Y 50Y MAX Chart Compare Export API Embed Malaysia Corporate Tax Rate In Malaysia the Corporate Income tax rate is a tax collected from companies. Last reviewed - 13 June 2022. On the first RM 600000 chargeable income.

Small and medium enterprises SMEs pay slightly different company tax as compared to other resident companies. Corporate tax rates for companies resident in Malaysia is 24. Rate The first RM600000.

No tax is withheld on transfer of profits to a foreign head office. Paid-up capital of more than RM25 million. 6 rows Petroleum income tax is imposed at the rate of 38 on income from petroleum operations in.

Malaysia raises interest rate to 225 amid. Restriction On Deductibility of Interest Section 140C Income Tax Act 1967 International Affairs. Tumbling rouble hits 62 vs dollar Rusal shares leap on merger talk.

Malaysia Corporate Tax Rate History. The CbC Rules require that Malaysian multinational corporation MNC groups with total consolidated group revenues of MYR 3 billion to prepare and submit CbC reports to the tax authorities no later than 12 months after the close of each financial year. Import duties Import duties are levied on goods that are subject to import duties and imported into the country.

On the First 50000 Next 20000. This rate is relatively lower than what we have seen in the previous year. Import duties are generally levied on an ad valorem basis but may also be imposed on a specific basis.

Tax rates on branch profits of a company are the same as CIT rates. Headquarters of Inland Revenue Board Of Malaysia. Insights Malaysia Budget 2019 Taxands Take.

Malaysias central bank on Wednesday Jul 6 moved to increase the key overnight policy rate OPR by 25 basis points to 225 per cent a move largely expected and in line with the forecasts of. On the First 10000 Next 10000. A Look at the Markets.

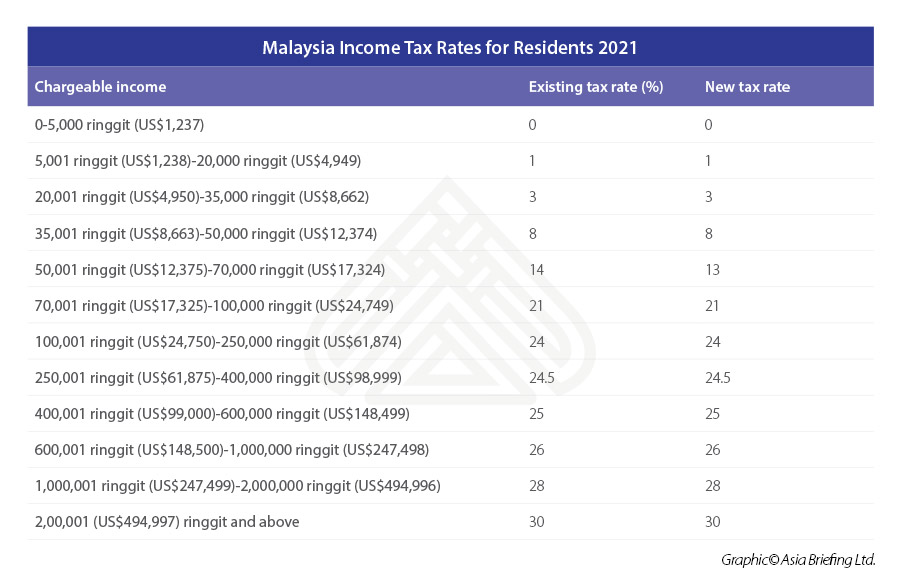

Historical Data by years Data Period Date Historical Chart by prime ministers Najib Razak Abdullah Badawi Mahathir Mohamad. Resident companies are taxed at the rate of 24 while those with paid-up capital of RM25 million or less and gross business income of not more than RM50 million are taxed at the following scale rates. See the global rankingsfor that indicator or use the country comparatorto compare trends over time.

WHT Dividends 1 Interest 2 Royalties 3a 3b Special classes of incomeRentals 4 5 Resident corporations. Although Malaysia is neither a tax haven nor a low tax jurisdiction for companies which are eligible for the tax incentives the effective tax rates may be significantly below the normal corporate tax rate of 24. For example in China India and Pakistan the corporate tax rate stands at 25 3461 and 31 respectively.

The maximum rate was 30 and minimum was 24. Ibu Pejabat Lembaga Hasil Dalam Negeri Malaysia Menara Hasil Persiaran Rimba Permai Cyber 8. Average Lending Rate Bank Negara Malaysia Schedule Section 140B.

Headquarters of Inland Revenue Board Of Malaysia. Rate TaxRM 0 - 2500. 21 hours agoRead more at The Business Times.

Corporate Tax Rate in Malaysia remained unchanged at 24 in 2021. Headquarters of Inland Revenue Board Of Malaysia. The corporate tax Malaysia 2020 applies to the residence companies operating in Malaysia.

Restriction On Deductibility of Interest Section 140C Income Tax Act 1967 International Affairs. Corporate - Branch income. On the First 20000 Next 15000.

Reduction of corporate tax rate for small medium enterprises SMEs on chargeable income of up to RM 500000 to 17 from 18 effective from YA 2019 Discover more. Therefore the corporate tax rate in Malaysia which is 24 is relatively low. These companies are taxed at a rate of 24 Annually.

On subsequent chargeable income. The average value for Malaysia during that period was 25 percent with a minimum of 24 percent in 2016 and a maximum of 28 percent in 2006. What is Corporate Tax Rate in Malaysia.

Business Income Tax Malaysia Deadlines For 2021

2022 Updates On Real Property Gain Tax Rpgt Property Taxes Malaysia

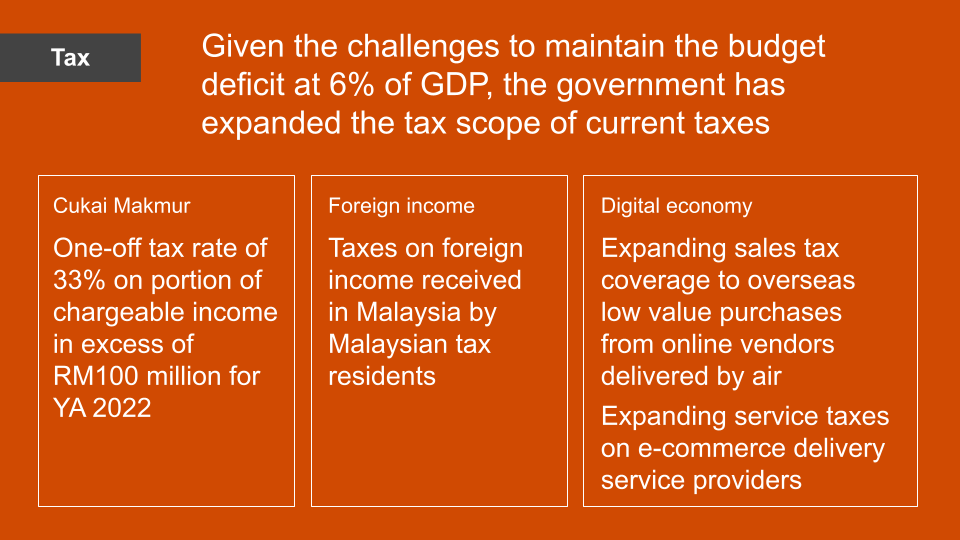

Malaysia Income Tax Rates For Residents 2021 Table Asean Business News

Tax Rates In South East Asia Philippines Has Highest Tax Hrm Asia Hrm Asia

Deadline For Malaysia Income Tax Submission In 2022 For 2021 Calendar Year L Co

Business Income Tax Malaysia Deadlines For 2021

Budget 2021 Tax Reduction For M40 Timely Yet More Could Be Done The Edge Markets

Malaysia Personal Income Tax Rates Table 2012 Tax Updates Budget Business News

Real Property Gains Tax Rpgt In Malaysia And Why It S So Important

Cukai Pendapatan How To File Income Tax In Malaysia

2022 Updates On Real Property Gain Tax Rpgt Property Taxes Malaysia

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

Updated Guide On Donations And Gifts Tax Deductions

Malaysia Personal Income Tax Rates Table 2011 Tax Updates Budget Business News

Deadline For Malaysia Income Tax Submission In 2022 For 2021 Calendar Year L Co

Why It Matters In Paying Taxes Doing Business World Bank Group

New 2022 Irs Standard Mileage Rates

Malaysia Personal Income Tax Rate Tax Rate In Malaysia